Copy Trading: Unlocking the Potential of Social Trading

In the world of finance, investing and trading have long been considered avenues for the select few with extensive market knowledge and experience. However, with the advent of copy trading, the dynamics of the investment landscape are changing. Copy trading enables individuals to replicate the trades of successful investors, opening up opportunities for novice traders and investors to participate in the financial markets. In this article, we will explore the concept of copy trading, its benefits, potential risks, and how to get started.

Understanding Copy Trading

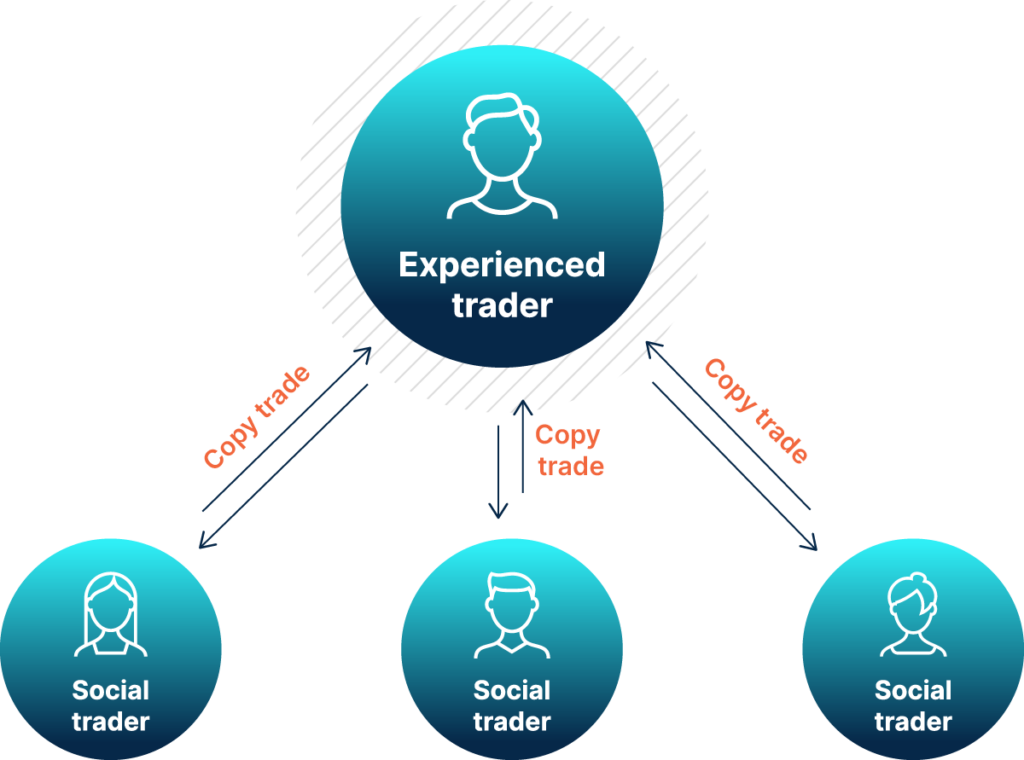

Copy trading, also known as social trading, is a form of online trading where individuals can automatically replicate the trades of experienced and successful traders. This concept is facilitated by specialized platforms that connect traders and investors, allowing them to follow and copy the trades of others in real-time.

Benefits of Copy Trading

- Accessibility and Simplified Trading: Copy trading makes trading accessible to a broader audience, regardless of their experience level. Novice traders can benefit from the expertise of seasoned professionals without having to spend years learning the intricacies of the financial markets.

- Learning Opportunity: Copy trading serves as an educational tool, providing an opportunity for less experienced traders to observe and understand the strategies and techniques employed by successful investors. It allows them to learn from real-world trading scenarios and gain insights into market dynamics.

- Time-Efficient: For individuals with limited time or expertise, copy trading offers an efficient way to participate in the financial markets. Rather than conducting in-depth market research and analysis, they can rely on the trades of experienced traders, saving time and effort.

- Diversification: Copy trading platforms typically offer a wide range of traders to follow, allowing investors to diversify their portfolios across different strategies and markets. This diversification can help reduce risk and enhance potential returns.

Risks and Considerations

While copy trading presents numerous advantages, it is essential to be aware of potential risks:

- Risk of Loss: Copying trades does not guarantee profits. The financial markets are inherently risky, and losses can occur. It is crucial to assess the track record and risk profile of the traders being followed, as past performance is not indicative of future results.

- Dependency on Others: When engaging in copy trading, investors rely on the decisions and actions of other traders. It is essential to choose traders carefully, considering their trading history, risk management practices, and consistency.

Getting Started with Copy Trading

- Choose a Reliable Copy Trading Platform: Research and select a reputable copy trading platform that aligns with your trading goals and preferences. Consider factors such as user interface, available markets, security measures, and user reviews.

- Perform Due Diligence: Before copying a trader, thoroughly research their trading history, performance metrics, risk management strategies, and overall approach. Look for consistency, risk-adjusted returns, and a track record that matches your investment objectives.

- Start with a Demo Account: Most copy trading platforms offer demo accounts that allow you to practice and familiarize yourself with the platform and its features. Use the demo account to understand how copying trades works and evaluate different traders.

- Define Your Risk Parameters: Set clear risk parameters, such as the maximum amount to invest in a single trade, maximum drawdown tolerance, and overall risk allocation. These parameters will help you manage risk and protect your investment.

- Monitor and Review: Regularly monitor the performance of the traders you are copying. Stay updated on market conditions and news that may impact their trading decisions. Continuously evaluate the performance of the traders and make adjustments if necessary.

Conclusion

Copy trading has emerged as an innovative solution, democratizing the world of trading and investment. By allowing individuals to follow and replicate the trades of successful traders, copy trading provides access to the financial markets for a wider audience. However, it is important to approach copy trading with caution, conduct thorough research, and understand the risks involved. With proper due diligence, risk management, and an understanding of the markets, copy trading can be a valuable tool for novice investors and traders to learn, diversify, and potentially generate returns in the exciting world of finance.